Finding Affordable Home Insurance Quotes in Conway, South Carolina

July 15, 2024, by Brad Davis, CIC

Conway, South Carolina, with its charming small-town feel, is an ideal place to call home. It has a beautiful historic downtown area and not as busy as the nearby coastal cities, but close enough for a quick trip to the beach. If you’re in the process of purchasing a property in this beautiful community, understanding the factors influencing homeowner insurance costs can be helpful.

In this blog post, we’ll dive into what affects home insurance premiums in the Conway area and provide tips on securing an affordable quote.

First Things First, How Much Does Conway Home Insurance Cost?

So, the question is – How much is home insurance in Conway, SC? Here we go!

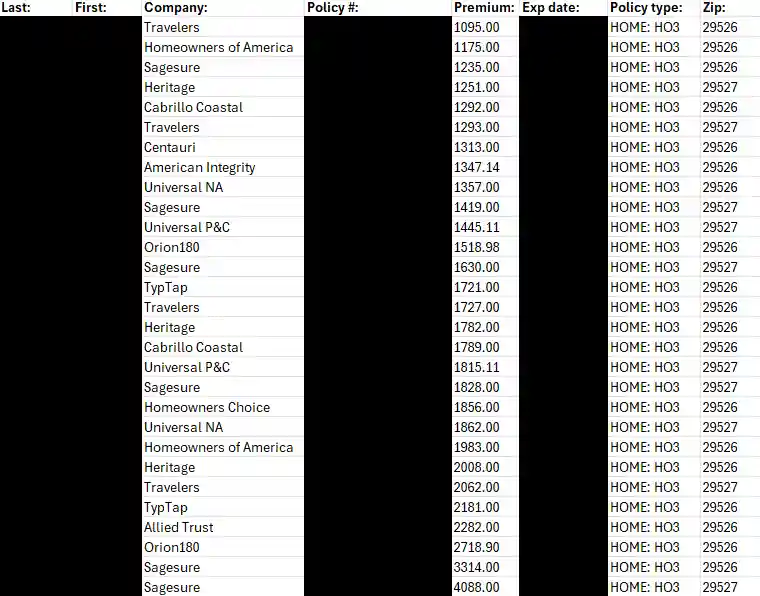

Keep in mind, there are several factors (shown further below), and your premium could (and probably will) vary from this. But in our agency, our average home insurance premium for a primary or secondary home in Conway, SC is right about $1764 for a year (and rising). This is really just to give you an idea of how much you can expect to pay for Conway Home Insurance. Rental properties are a little different.

If you are looking for Condo Owners Insurance (HO6) feel free to visit our website page for Condo Units.

The above picture is small sample of the home insurance policies I pulled from the Conway area that we carry – just to show I didn’t pull $1764 completely out of the air. This encompasses Zip codes 29526 & 29527 in Conway. *This is just a sample of home insurance policies that are in Conway. Average premiums will be different almost everywhere. The average age of the home, location, and many other factors will impact this. Some of these homes have Dwelling Coverage (Coverage A) of $175,000 and some have close to $700,000.

IT IS MOST COMMON TO SEE PREMIUMS IN THE RANGE OF $1000 – $3,500 FOR HOME INSURANCE IN THE CONWAY, SC AREA.

Request a Home Insurance quote from Davis Insurance Associates.

Factors Impacting Home Insurance Costs:

Coastal Proximity:

Since Conway sits not too far from the Atlantic Ocean, home insurance rates are influenced by the increased risk of hurricanes and tropical storms.

Home Characteristics:

Factors like age, construction, and square footage can significantly impact insurance costs. Newer, well-constructed homes may qualify for discounts.

Insurance History:

Homes with a history of frequent claims may be considered higher risk, resulting in higher insurance premiums.

Local Fire Protection:

Homes not located close to a fire station (usually five miles) will typically pay higher insurance premiums due to longer emergency response times.

Credit Score:

Maintaining a good credit history is crucial, as it can positively or negatively influence insurance rates.

Deductible and Coverage Limits:

Adjusting your deductible and coverage limits can directly affect your overall premium. It’s pretty well known that higher deductibles can lower your premium.

Check out our other blog posts about Home Insurance.

Understanding Average Costs:

Doing a quick internet search can give you an idea of the average home insurance cost for South Carolina. What I see in our agency is that the premiums for homes in Conway are pretty close to the average for the state.

As mentioned above, the age of your home plays an important part in the home insurance rate. Homes over 20 years old can pay up to double the premium when compared to a new home.

Tips for Affordable Home Insurance:

Bundle Policies:

When you can, combine home and auto insurance with the same provider (or agency) to benefit from potential discounts.

Home Security Systems:

Install security systems to make your home less risky to insure and potentially qualify for discounts.

Maintain a Good Credit score:

Regularly check and improve your credit score to qualify for lower insurance rates.

Conclusion:

If you’re in the market for a home insurance quote in the Conway area, understanding the local factors influencing costs is key. By considering coastal risks, home characteristics, and implementing cost-saving measures, you can find an insurance policy that not only protects your investment but also fits within your budget. For personalized advice tailored to your needs, consult with insurance professionals who are familiar with the specific considerations of insuring homes in Conway, SC.

Lastly – Be careful if you are only searching for the cheapest home insurance in Conway. You may find that companies advertising they have the lowest rates in Conway or certain areas are not the best fit for you. Work with a trusted agency that is looking out for you while also looking for ways to bring you the best value!

*Don’t forget to consider Flood Insurance.*

Care to see what we can do for your home insurance in Conway, SC? Please call or text (843) 213-0000.

Workers comp Experience Mods and how they affect your premium and ultimately your bottom line.

Workers comp Experience Mods and how they affect your premium and ultimately your bottom line. Switching Auto Insurance After Moving to Myrtle Beach, SC | Car Insurance - Davis Insurance Assoc

Switching Auto Insurance After Moving to Myrtle Beach, SC | Car Insurance - Davis Insurance AssocDon’t forget to share this post

Why Choose Davis Insurance Associates, Inc.?

If you’re looking for affordable and reliable insurance in South Carolina or North Carolina, Davis Insurance Associates, Inc. is your trusted local partner for personal and business insurance solutions.

We understand that every person, family, and business has unique risks. Whether you need home insurance, auto insurance, flood insurance, condo insurance, boat insurance, or business insurance, we’re here to help you find the right coverage – without the stress.

As an independent insurance agency, we work with many top-rated insurance carriers to compare quotes and deliver options that offer great protection at competitive prices. Unlike agencies that represent just one company, we shop the market for you – so you get custom insurance solutions tailored to your needs.

Fast, Simple, and Personalized Insurance Quotes

We know your time is valuable. That’s why we created a fast and secure online form (button below) that typically takes just 5–10 minutes to complete. This efficient process allows us to gather the essential information upfront – saving you from multiple back-and-forth calls and emails.

After you submit the form and share your current insurance policy details, we spend dedicated time reviewing your situation, shopping quotes, and designing coverage that protects what matters most to you. But don’t worry, we work fast!

We still value real conversations. We’ll gladly connect to talk through your needs, listen to your concerns, and make sure the insurance you choose is exactly right for your home, vehicle, business, or lifestyle.

What Sets Davis Insurance Associates Apart?

Independent insurance agency serving both South Carolina and North Carolina

Access to multiple insurance carriers for the best mix of price and coverage

Local knowledge with a personal, client-first approach

Fast, convenient online quote process

Experience in both personal and commercial insurance

If you’re ready to review your current policies or start fresh with a local expert, let Davis Insurance Associates help you make a smarter insurance decision. Get in touch today, and let’s find coverage that truly fits your needs and budget.

The next step is easy, call us at 843-213-0000, or click below to start your insurance quote

Related Articles

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only. It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional in your state. By using this blog site you understand that there is no broker client relationship between you and the blog and website publisher.